UPS Commercial Invoice Template

Download the UPS commercial invoice template to request payment for exports shipped with UPS. These invoices provide an official form to list everything in a shipment, all the associated costs, shipping details, and related information. Keep copies of each invoice for your financial records.

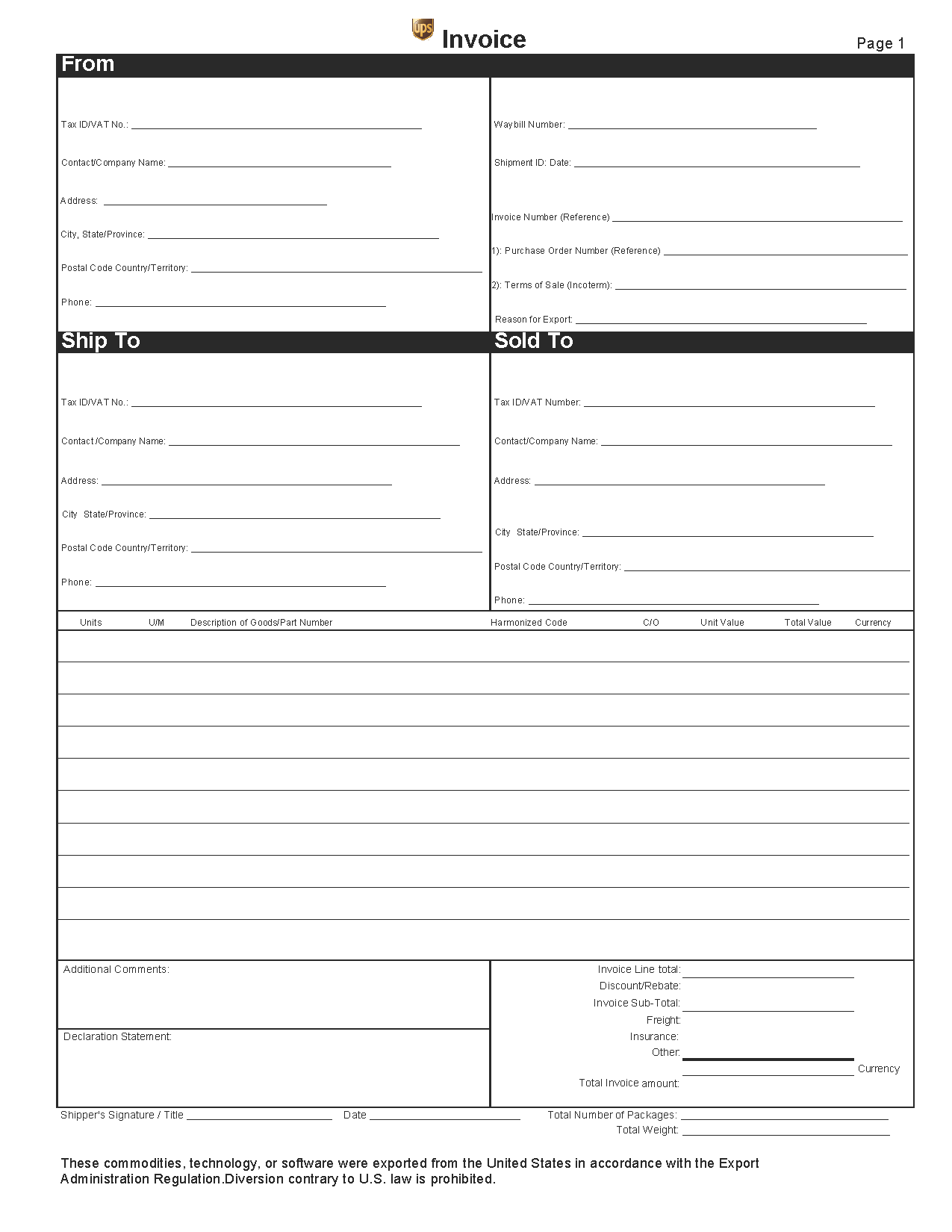

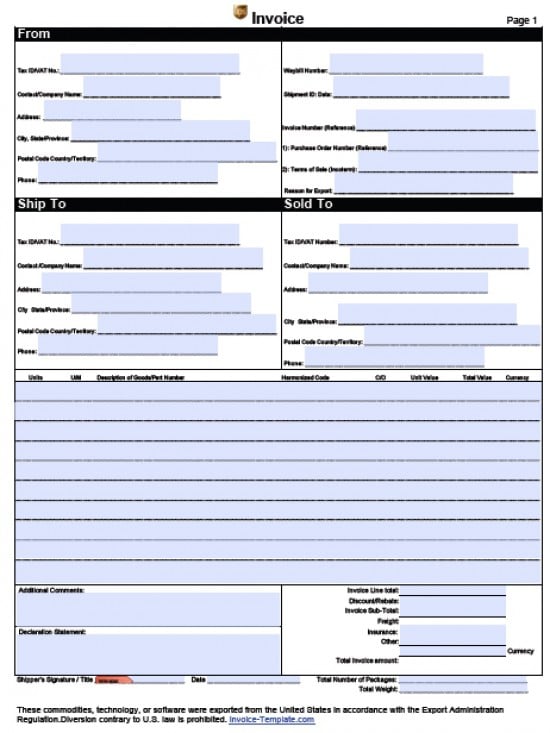

How to Make in Adobe PDF and Microsoft Word

Step 1 – Download in Adobe PDF (.pdf) or Microsoft Word (.doc).

Step 2 – From – In this box, enter the value added tax number followed by the name, address, and phone number of the company that’s sending the goods. Then enter the waybill number issued by the shipper, as well as the shipment ID and date and the invoice number. Include the purchase order number, and the Incoterm, that is, the three-letter international trade term that describes this transaction. Next, fill in the reason for export, such as repair, gift, or sale.

Step 3 – Ship To and Sold To – Fill in the value added tax numbers and contact information for the recipient and the buyer here.

Step 4 – Table – For units, enter the quantity for each type of good in the shipment, and enter the units of measure for each (e.g., ounces, boxes) under U/M. Describe each good and enter its part number as well. Under Harmonized Code, fill in the tariff code customs should use to classify the goods. C/O refers to country of origin. To the right, enter the unit and total values of each row, followed by the currency.

Step 5 – At the bottom, total up the cost of the goods with any freight or insurance costs, and indicate the total weight and number of packages. Sign the form and include any special comments to complete it.

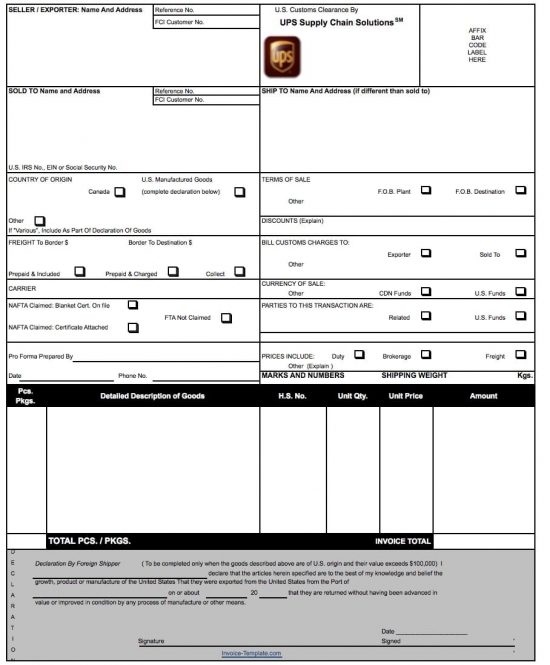

How to Make in Microsoft Excel

Step 1 – Download in Microsoft Excel (.xls) (Also known as the UPS Pro Forma Invoice).

Step 2 – At the top, enter the shipper’s name and address along with its reference number and first class international shipping number, if applicable. Then enter the name and address of the buyer, and if different from the buyer’s address, fill in the Ship To address.

Step 3 – Next, indicate the country of origin, and fill in the terms of sale and any discount. Choose FOB destination, for example, if the shipper is paying the freight charges.

Step 4 – In the Freight field, show how much the cost of transport is to the border and from there to the destination, and show whether the cost is included or to be collected. To the right, show who will pay customs charges.

Step 5 – NAFTA – Indicate whether the shipment qualifies for NAFTA preference, as this relaxes tariffs on goods shipped between NAFTA countries.

Step 6 – In the Pro Forma box, fill in the name of the person who prepared this form, along with the date, and phone number. Then indicate what the final price includes as well as the shipping weight.

Step 7 – Table – Here, list the quantity of each good shipped and a description of each. HS number refers to the harmonized tariff code. List the unit price for each good, calculate the totals for each, then add the amount column to get the total cost of the goods.

Step 8 – If applicable, complete the foreign shipper declaration, and then sign and date the bottom of the form.