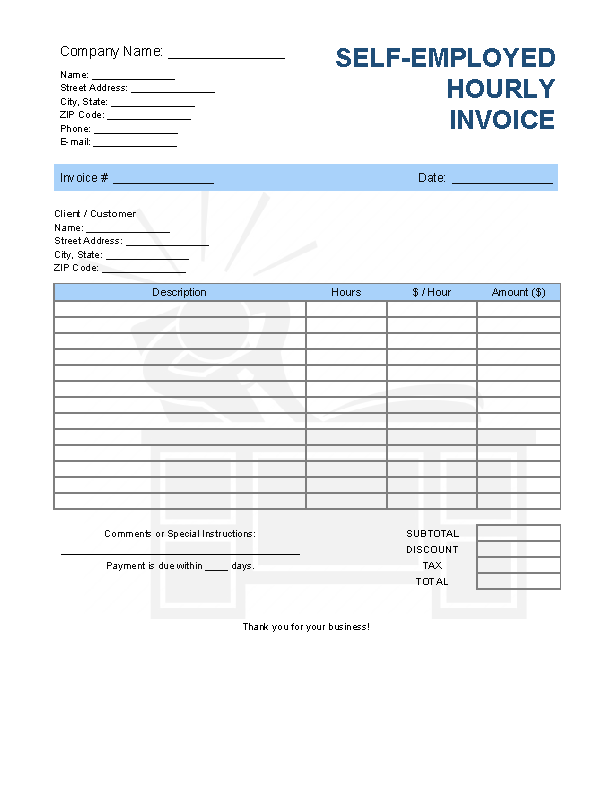

Self-Employed (Freelancer) Hourly ($/hr) Invoice Template

The self-employed hourly invoice template is a statement of charges used by any freelancer or 1099 independent contractor that has decided to bill a client for their labor on an hourly basis. The invoice should be calculated by adding the number of hours worked multiplied by the hourly rate, which will have been agreed upon before the work started. If there are any local taxes levied on the service, they should be added at the bottom of the invoice before the total amount is calculated. (The self-employed party, not the client, will be responsible for any and all withholding taxes.) The invoice must be sent to the client after work is completed so they may look over the charges to make sure they are fair. Once the number of hours is deemed appropriate, the client must make payment as per the time period expressed on the invoice.

IRS 1099-MISC Form – Use to file withholding taxes at the end of the fiscal year to the federal government.