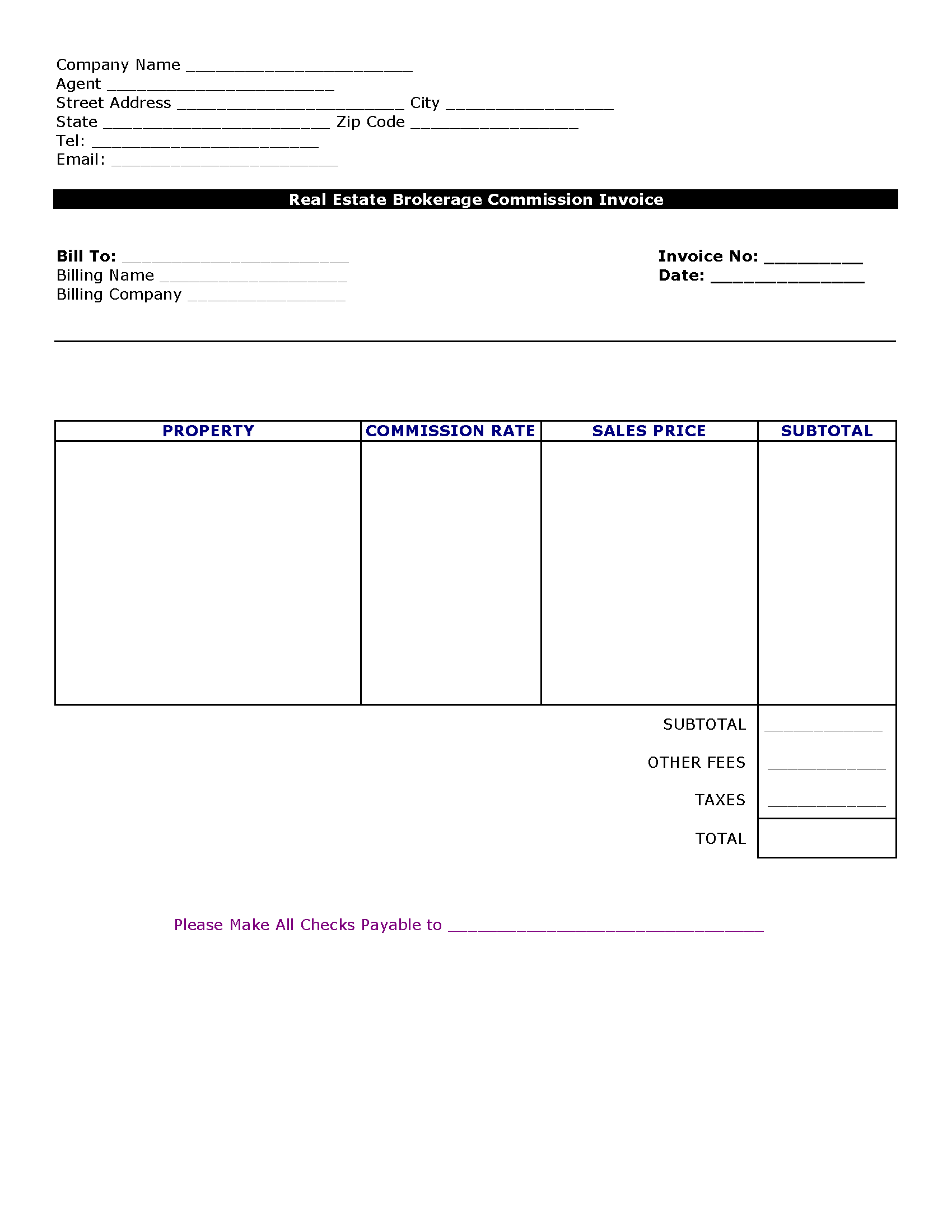

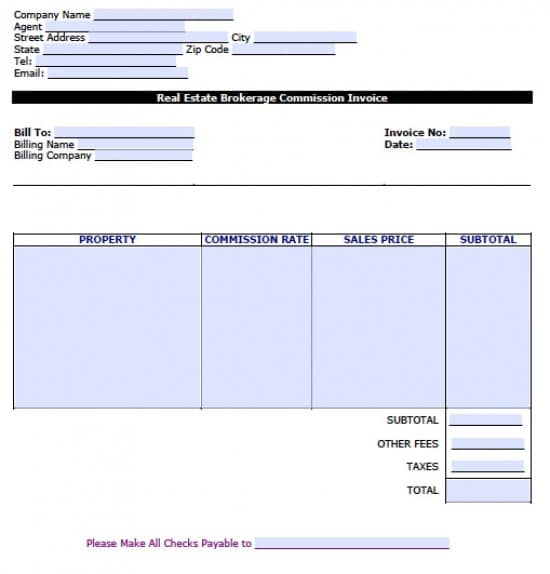

Real Estate Brokerage Commission Invoice Template

Download the real estate brokerage commission invoice template to request commission payment for a real estate broker for finalizing the sale or lease of real estate. The invoice should reflect the same commission rate (%) that was agreed upon between the agent and client in the listing agreement. At the closing, the seller/lessor or residential or commercial property will pay the percentage of the face value of what is owed before taxes or other fees. This is the amount listed in the agreement.

Table of Contents

How to Calculate

A real estate commission is calculated by multiplying a percentage (%) of the total amount ($) sold or the total lease rate for the term of the agreement, less extensions or renewal options.

Calculating a Purchase and Sale

The average real estate commission for a sale somewhere between 5% to 6%. If there are two (2) agents involved, for each buyer and seller, the commission amount will be split unless there is another arrangement between the parties.

Example: $300,000 home with a 5% commission would an invoice in the amount of $15,000. The invoice should be payable at the time of closing by the seller.

Calculating a Lease

The average real estate commission for a lease, commercial or residential, is 4% to 6%. The invoice is commonly paid at the time of lease signing or upon possession by the tenant.

Example: Tenant agrees to pay $1,000 per month for two (2) years with a 5% commission would garner a $1,200 commission.

Verify Real Estate Licensees

Use to input the real estate agent license number on the invoice and to verify the agent is active and allowed to practice their profession.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

How to Make in Adobe PDF and Microsoft Word

Step 1 – Download in Adobe PDF (.pdf) or Microsoft Word (.doc).

Step 2 – At the top, enter the company name, the agent/broker’s name, and the address and contact information for the company.

Step 3 – Bill To – List the personal information of the person or company that owes the broker a commission, which will usually be the buyer or seller of the property, and include the number and date of the invoice.

Step 4 – Table – For each property involved in the transaction, enter the address in a separate row. Then include the commission rate agreed to for that property and the sale price to the right to arrive at the total amount due to the broker. Add the figures in the subtotal column to get the subtotal, and add any other fees or taxes to reach the grand total the broker is owed.

Step 5 – Include the name to make checks payable to at the bottom if needed.

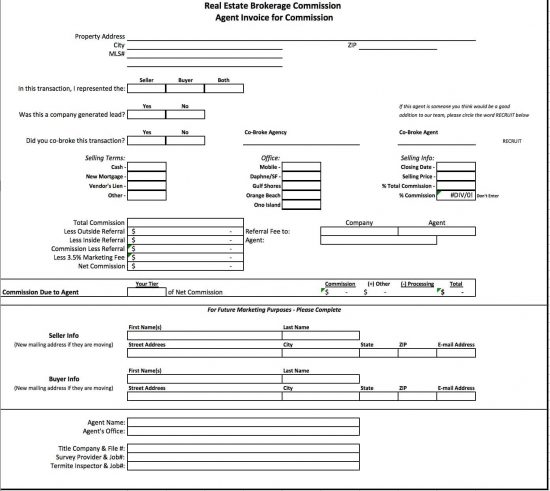

How to Make in Microsoft Excel

Step 1 – Download in Microsoft Excel (.xls).

Step 2 – Property Address – Enter the address of the sold property at the top. Then specify whether the broker represented the buyer, seller, or both, and whether this was a company-generated lead, and whether there was a co-broker.

Step 3 – Selling Terms and Info – Select the type of payment, the office information, and list the selling date, total sale price, and commission percentage to the right.

Step 4 – Total Commission – Enter the total commission received from the sale, then enter the amount removed for referrals, marketing fees, and so on, to reach the net commission that the broker will receive. Write the agent’s name and company to the right.

Step 5 – For Future Marketing Purposes – Fill in the buyer and seller’s contact information here to retain it for marketing other deals in the future. At the bottom, list the agent’s name and office location, as well as the survey provider and termite inspector number.